GST 2.0: What Every Retailer Must Know

GST 2.0: What Every Retailer Must Know

By Charu Gupta Published: September 25th, 2025

India’s Goods and Services Tax (GST) has just gone through one of its biggest reforms since its launch in 2017. From 22 September 2025, GST 2.0 is live, bringing with it simplified slabs, reduced rates on essentials, and stricter compliance expectations.

For retailers, this is both an opportunity and a challenge. Prices of daily-use products have dropped, customers are expecting benefits to be passed on, and businesses must act fast to update systems and processes.

This blog breaks down everything you need to know about GST 2.0, what changed, what items are cheaper, and the exact action plan retailers must follow.

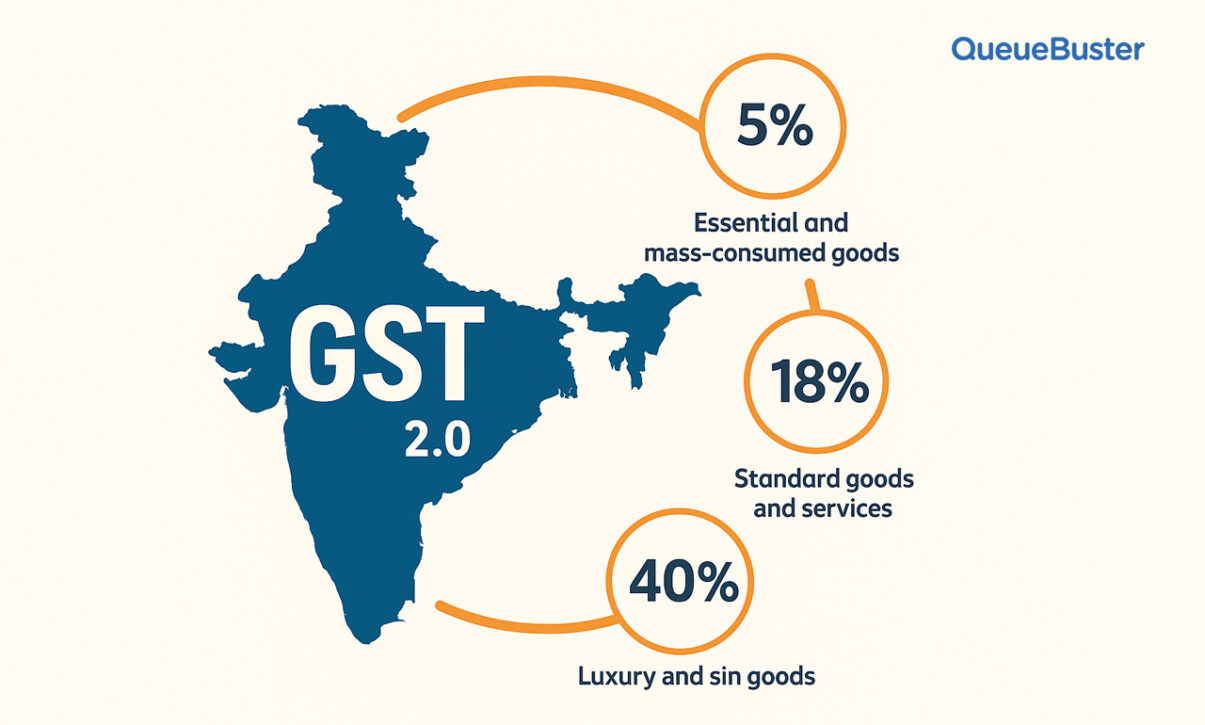

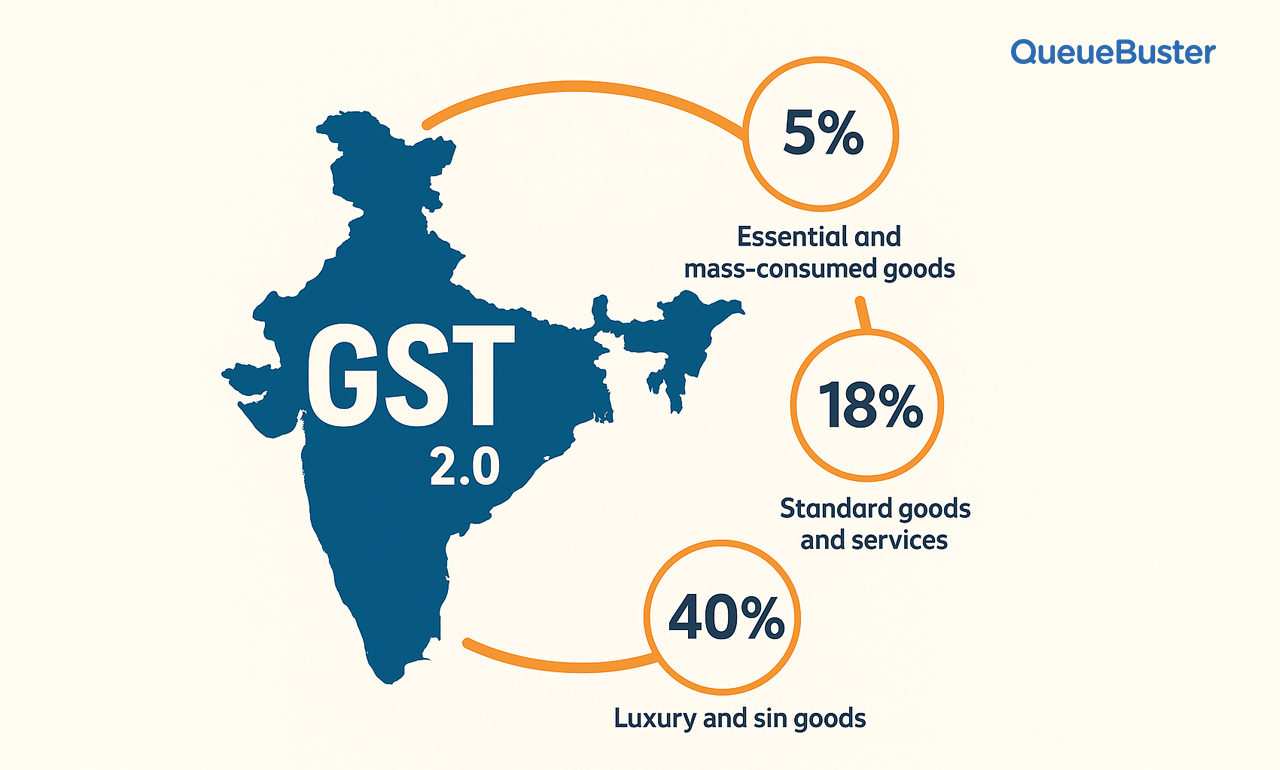

GST 2.0 Slab Simplification

Earlier, India’s GST system had four main slabs: 5%, 12%, 18%, and 28%. While this gave flexibility, it also caused confusion and compliance headaches. With GST 2.0, the structure has been streamlined into just three clear tiers:

- 5% – for essentials and daily-use items like soaps, toothpaste, packaged food, and baby products.

- 18% – for standard goods and services, including most electronics and mid-range consumer products.

- 40% – for luxury and sin goods such as tobacco, premium vehicles, and gambling-related services.

- This rationalisation means less confusion, easier billing, and a smoother audit trail for businesses.

Big Reductions: What Items Are Now Cheaper

The real highlight of GST 2.0 is the massive rate cuts for consumer essentials and popular retail products.

- Daily essentials – Soaps, shampoos, toothpaste, baby diapers, namkeens, chocolates, and biscuits have dropped from 12–18% GST to 5%.

- Electronics – Items like ACs, large-screen TVs, and dishwashers are now taxed at 18% instead of 28%, making them more affordable.

- Hospitality sector – Hotel room tariffs up to ₹7,500 and food menus in such hotels see lowered GST.

- Pharma – Nearly 80% of medicines previously at 12% are now taxed at 5%, giving relief to end consumers.

However, retailers should note:

- Pre-manufactured stock (produced before 22 Sept) may continue to be sold under old MRPs.

- In some cases, customers might not immediately see price drops until old stock clears.

What Retailers Should Do: Your Action Plan

This is where retailers need to act fast. To stay compliant and competitive, follow this checklist:

1. Update Your Billing Systems

Your billing and invoicing must reflect the new GST slabs immediately. The easiest way to do this is by upgrading your POS software so it automatically applies the correct tax rates. Without this, you risk overcharging customers and facing compliance penalties.

2. Revise MRPs and Price Tags

Update shelf labels and price stickers where necessary. Customers expect to see lower prices, and visible transparency builds trust.

3. Communicate the Benefit

Use banners, posters, and social media posts to highlight the reduced GST. A message like “Now at 5% GST – Pay Less, Save More” can drive footfall.

4. Train Your Staff

Staff must know the new rates, correct HSN/SAC codes, and how to explain changes to customers. A well-trained team reduces billing errors and customer disputes.

5. Manage Inventory Wisely

Separate old stock from new. Consider offering discounts on pre-GST 2.0 stock to clear shelves faster and make space for fresh, lower-tax products.

6. Monitor Compliance

Check invoices carefully to ensure the right GST is charged. Any overcharging can lead to customer complaints, especially now that consumers are alert to the reforms.

Why GST 2.0 Matters for Your Retail Business

This reform is more than a tax cut—it’s a growth opportunity.

- Competitive pricing: With lower rates, you can price products more attractively and boost sales.

- Simpler compliance: Fewer slabs mean fewer errors in billing and easier audits.

- Customer trust: Passing on benefits openly builds goodwill and loyalty.

- Festive demand: With Diwali and the holiday season ahead, reduced GST rates will likely increase consumer spending.

Retailers who adapt quickly updating their POS software, revising pricing, and communicating benefits stand to gain the most.

Final Word

GST 2.0 signals a new era of simplified taxation in India. For retailers, the message is clear: move fast, stay transparent, and leverage technology to stay ahead.

If your billing systems aren’t yet ready, now is the time to upgrade your POS software and ensure your customers see the benefit immediately. Those who act quickly will not only stay compliant but also win customer loyalty and drive higher sales in the festive months ahead.

Popular Posts

Common Challenges in Payment Gateway Integration and How to Solve Them

In today’s digital-first marketplace, businesses across the UAE rely heavily on seamless […]

Why Cloud POS Is Gaining Higher Market Share in the UAE

The UAE’s retail and hospitality landscape is evolving at a rapid pace. […]